Calculate a Company's Total Leverage Given the Following Information

Change in sales 3. A high expected return and a low price.

Lemon Greentea Globe At Home Unveils New Postpaid Plans With More Globe At Home Wifi Mesh Android Tv Box

Calculate a companys total leverage given the following information.

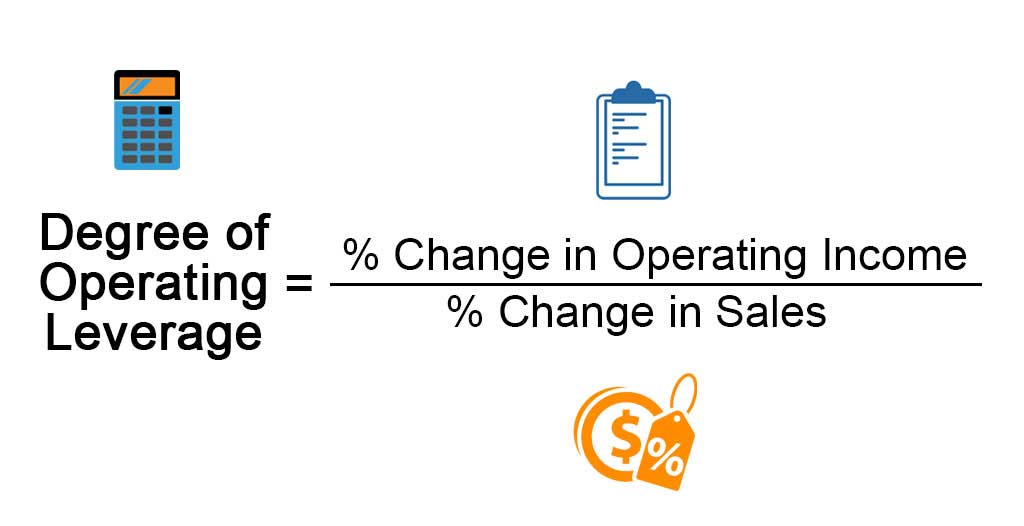

. Operating leverage contribution margin operating income. Calculate a companys total leverage given the following information. Given the following information calculate the operating leverage factor for Company A B respectively.

Calculate a companys total leverage given the following information. What is your expected return after one year. Companys total leverage To calculate companys Total View the full answer.

Change in sales 55 Change in earnings 7. Now calculate each of the 5. Net income 80000 Revenue 120000 Variable costs 25000 114 119 Cannot calculate without EPS data Cannot calculate without knowing degree of financial leverage.

Variable costs 25000. Cost of debt on a 100000 bond. Calculate a companys total leverage given the following information.

60 56 74. Calculate a companys total leverage given the following information. 43 49 45 53 CONCEPT Expected Return 2 Which of the following credit ratings would make a country or company have the easiest time.

The two key leverage ratios are. Change in sales 3 Change in earnings 9 a. Imagine a business with the following financial information.

15m15m 3m 125 x 15m 3m 15m 3m 15m 114. 100 000 30 000 60 000 10 000 displaystyle 100000-30000-6000010000. Niccherip5 and 1 more users found this answer helpful.

1 You own a small manufacturing business that produces widgets. 10000 13482 11539 19950. Cost of Debt Risk Free Rate Credit Risk Rate 2 6 8 Total Cost of Debt Bond Value Cost of Debt 100000 8 8000 Ans.

Calculate a companys total leverage given the following information. Total fixed expenses will remain constant 4. Net income 80000.

25 million of equity. Change in sales 3. A high leverage ratio calculates that the business may have taken too many loans and is in too much debt compared to the businesss ability to service the debt with future cash flows.

Change in earnings 9. If the operating leverage for Company A is 6 and sales increase by 3 there is a. A security that falls above the security market line has __________.

Leverage ratio example 1. 70 000 10 000 7 displaystyle 70000100007. The figure can then be used to help the company determine what its new EPS will be if it sees a 10 increase in sales revenue.

Net income 35000 Revenue 70000 Variable costs 15000 a Cannot calculate without knowing the degree of operating leverage b Cannot calculate without ROE data c 233 d 157. The operating income is. 8000 Ans 02.

Calculate a companys total leverage given the following information. Cannot calculate without EPS data. - Change in sales 7.

Cannot calculate without net income data. Net income 40000 Revenue 60000 Variable costs 10000 2 b Cannot calculate without EBIT data c Cannot calculate without EPS data d 125. Calculate a companys total leverage given the following information.

5 million of annual EBITDA. - Change in earnings 10. Thinking About Financial Leverage.

Principle of Finance Milestone 3 Sophia Course 1 You invest 1000 in a stock that has a 15 chance of a 1 return a 60 chance of a 5 return and a 25 chance of a 7 return. 20 million of debt. Change in net income.

Change in sales 3 Change in earnings 9 a Cannot calculate without net income data b. 125 x 114 143. Change in sales 7.

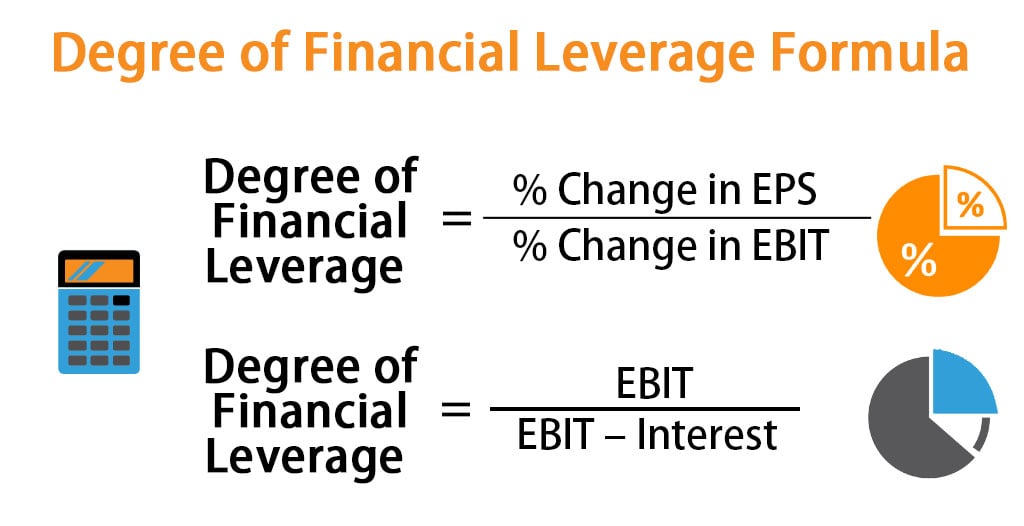

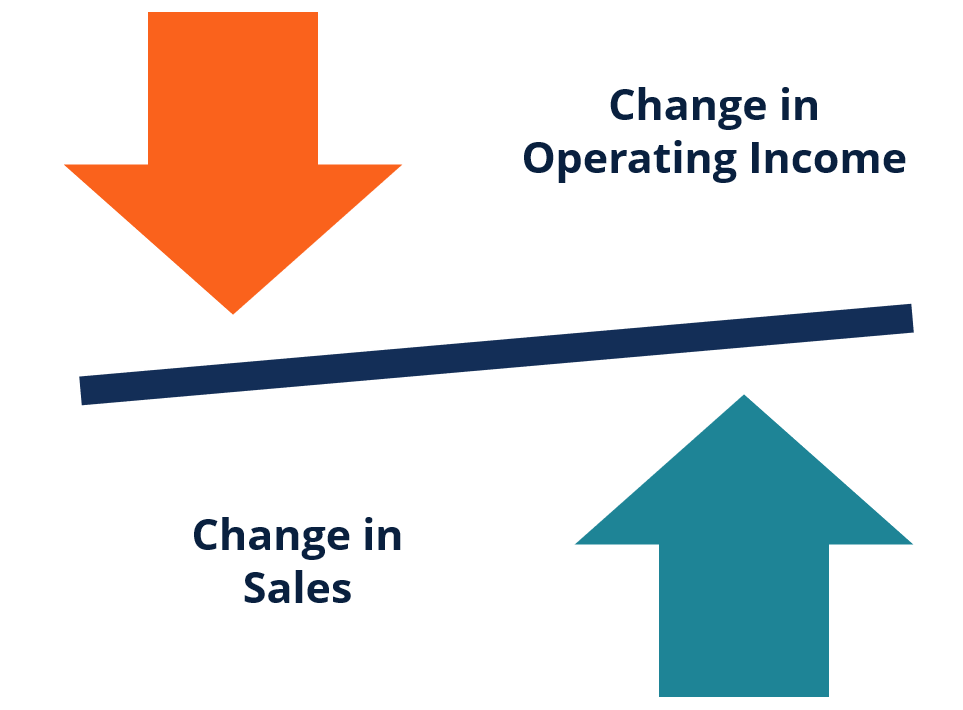

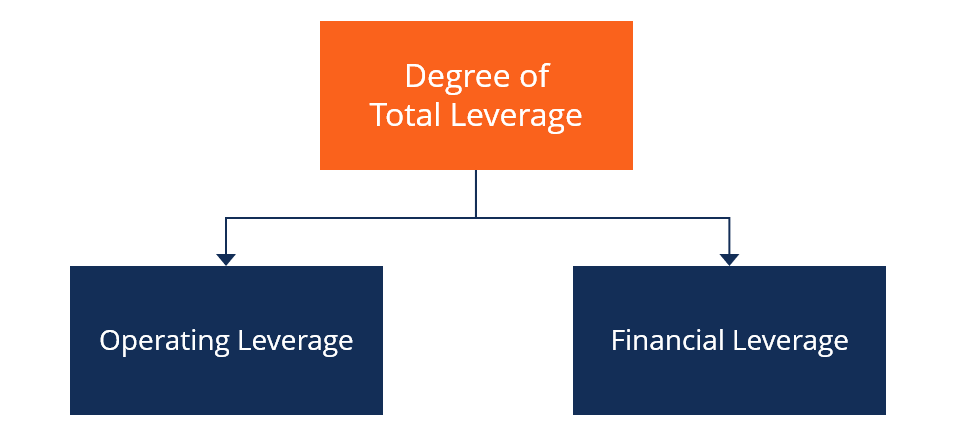

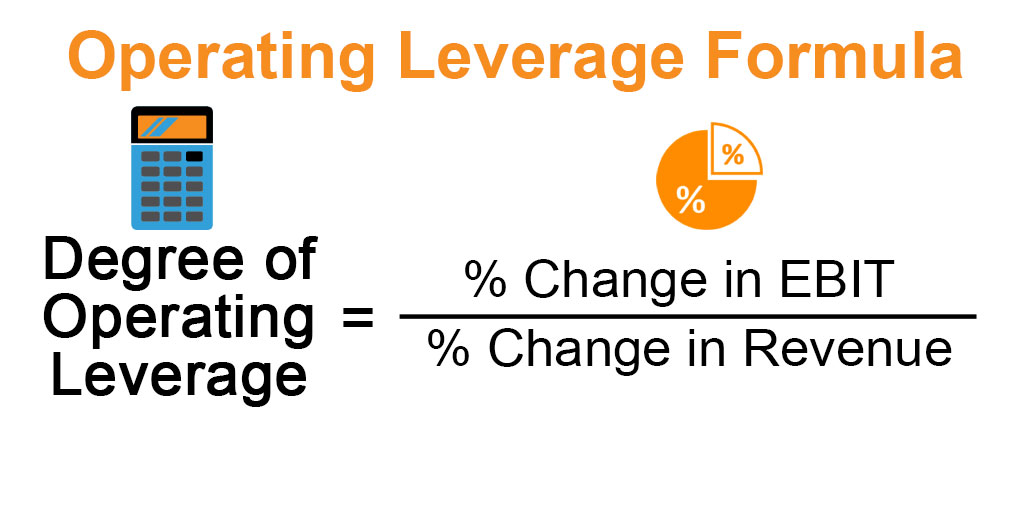

Calculate a companys total leverage given the following information. Total Leverage Operating Leverage Financial Leverage. Calculate a companys total leverage given the following information.

Net income 40000 Revenue 60000 Variable costs 10000 a 2 b Cannot calculate without EPS data c Cannot calculate without EBIT data d 125. Total leverage is equal to the ratio of percentage change in earnings per share to percentage change in sales revenue. 2 million of annual depreciation expense.

The degree of total leverage for Company ABC is 143. Change in earnings 9. Financial Leverage EBIT EBT.

The sales mix remains constant. - Change in sales 55 - Change in earnings 7. Operating Leverage Contribution Margin EBIT.

Change in sales 55 Change in earnings 7 O 127 O Cannot calculate without ROE data O Cannot calculate without EBIT data O 079. The calculation should look something like this. Over-valued for its level of risk attractive for a company raising capital attractive for an investor correctly valued for its level of risk.

Calculate a companys total leverage given the following information. Higher contribution margin. Debt ratio Debt Ratio The debt ratio is the division of total debt liabilities to the companys total assets.

50 million of assets. Calculate a companys total leverage given the following information. Cannot calculate without knowing degree of financial leverage.

Change in earnings 10. Calculate a companys total leverage given the following information. 3 X 6 18.

80000 80000. We need to find a companys total leverage. Hence companys total leverage is 3 units.

Converge Enterprise Is A Cloud Based Crm It Is Designed To Offer Comprehensive Business Solution To Smbs Through Marketing Solution Intelligent Marketing Crm

Patience Stock Chart Patterns Stock Charts Money Trading

Quality Management System In 2021 Supply Chain Management Management Supply Chain

The Role Of C Suite Executives Ceo Cfo Coo Infographics Cfo Chief Financial Officer Chief Marketing Officer

The Role Of The Social Ceo In A Crisis Communications Infographic Corporate Communication Communication Plan Template Communications Plan

Ar Vr Xr On The Web On Twitter Media Strategy Social Media Strategies Mobile Marketing

Degree Of Financial Leverage Formula Calculator Excel Template

Operating Leverage Formula And Excel Calculator

Get Our Example Of Employee Compensation Plan Template For Free How To Plan Compensation Online Business Plan Template

Tobin S Q Ratio Accounting And Finance Financial Strategies Business Content

Degree Of Operating Leverage Definition Formula And Example

Tips For Writers And Media Organizations On Pinterest Pinterest For Business Writer Organization

Degree Of Total Leverage Definition Components How To Calculate

Operating Leverage Formula Calculator Example With Excel Template

Mcqs On Financial And Strategic Management Leverage

Degree Of Operating Leverage Defintion Examples With Excel Template

Long Term Solvency Ratios Financial Statement Analysis Youtube

How Does Duolingo Make Money Duolingo Business Model In A Nutshell Fourweekmba In 2021 Interactive Learning Duolingo Game Based Learning

Comments

Post a Comment